Budgeting Season Doesn’t Have to Be a Pain for Multifamily Marketers.

Updated August 2023

Renter demand, occupancy, and multifamily market conditions are not always flat month over month, so why should your budget be? Here are 3 important data points to consider for a smarter and more strategic approach to your apartment marketing budget.

1. Search Volume In Your Market

In order to get a better idea of when to spend your money on Google Ads, you should look at the last 12 months of searches in your market. Across the US, we see apartment searches drop off in Q4, spike in Q1, and reach their highest in Q2/Q3. Keep in mind this may vary slightly in different multifamily markets.

When looking at Orlando, FL we see that March is the highest month for multifamily searches in that market, and October is really strong as well.

So what does this mean for apartment marketing and spending strategy?

We Recommend: Don’t spend the same budget every month. Fiona will do it for you.

Fiona Budget Recommendations

While paid advertising spending can change month-over-month depending on goals, a general rule of thumb is to increase your budget when apartment seekers are researching their next home (Q2/Q3) and lower your budget when things are slower (Q4). Once you get comfortable with that general rule, you will want to layer in how cost per click changes in your market as well.

The same goes for your occupancy. It should go without saying that you should be more aggressive with your budget during the lease-up phase and frugal with your budget when you get closer to stabilization. Here are the most common mistakes we see multifamily marketers make:

- Shutting off a digital campaign completely once their property is stabilized (~90%). You will still need a maintain your property’s online presence, such as SEO, Reputation Management, and Organic Social services.

- Not focusing on expiring leases and resident retention. It is far more damaging to your budget to restart the marketing engine than it is to have a constant digital presence.

- Not thinking 90 days ahead. Keep in mind that the average apartment buying cycle is 32 days, so planning is at least 1 month ahead.

2. Seasonality Across Mobile, Social, Email and Display Platforms

Now that you have your paid search trends down, you should look at how other digital platforms have performed in your market. And why not look at just your specific targeted audience, your future residents?

For example, in Los Angeles, the number of renter devices on mobile saw a huge spike in May, dropped back down in June and July, and then spiked again in August. All while social, email and display renter devices remained relatively constant. In this scenario, your mobile budget should fluctuate according to the trends. Do keep in mind your audience and where they are the most active. Read more in our blog about Gen Z renters and Millennials, as they will likely be more active on mobile.

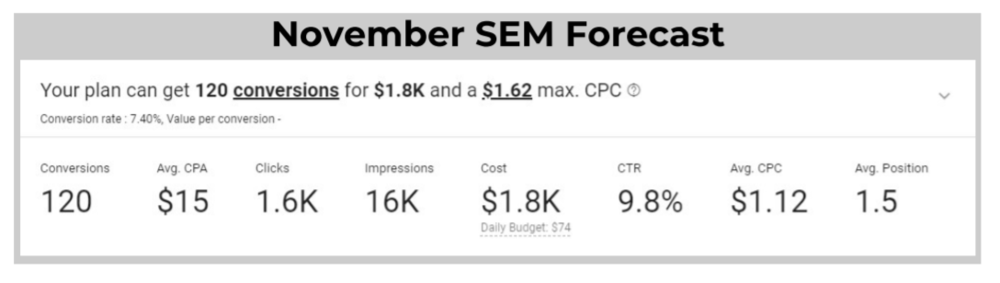

3. Forecasted Performance of SEM Campaign

Now that you’ve gathered historical data on a market, you can use that data to forecast the future.

In this scenario, we are looking at historical lead data for the market (example above) and forecasting what the CPA (cost per acquisition) should be in this market for November. In this case, if you want to maintain a CPA of $15 the most this market can efficiently support is $1,800 in media spend. While you can certainly spend more, it will drive up your CPA.

Does multifamily marketing budgeting and planning have your head spinning? We’ve got you covered. We’ll take this stress off your plate with monthly marketing budgets curated by our AI, Fiona. She knows her data, and market trends, and knows exactly how to recommend budget spend. Reach out to us to get started with your Fiona budgeting demo.