Overview & Purpose

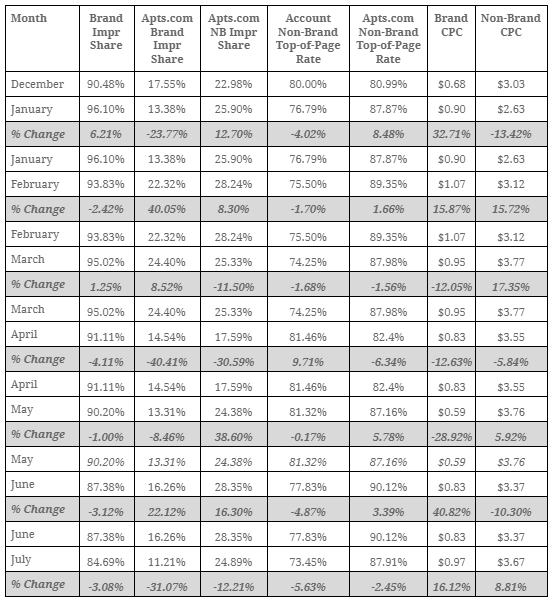

Towards the end of December, Apartments.com announced a planned $100 million increase in paid search and media spend for 2020. With this in mind, we measured impression share for brand and non-brand campaigns to understand how apartments.com additional media spend is affecting our paid search campaigns. We started the research earlier this year and released our first blog covering performance insights through most of Q1.

Brand impression share = Impression share (IS) is the percentage of impressions that your ads receive compared to the total number of impressions that your ads could get for brand terms.

Non-Brand Impression share = Impression share (IS) is the percentage of impressions that your ads receive compared to the total number of impressions that your ads could get for non-brand terms.

Top of Page Rate = how often your ad (or the ad of another participant, depending on which row you’re viewing) was shown at the top of the page, above the unpaid search results.

Findings

Conclusion

Apartments.com increased their presence in Google search drastically in the first two months of 2020. However, COVID-19 appeared to throw a wrench in advertising plans, as apartments.com decreased their presence in both brand and non-brand impression share from February to March and March to April.

As America slowly started re-opening in May, apartments.com followed suit with advertising strategy. The ILS increased presence in non-brand from May to June and June to July, while only increasing presence in branded searches from May to June.

Overall, the average non-brand CPC has increased 21% from December 2019 to July of 2020. The average brand CPC has increased 42% over the same time period. The data proves apartments.com is shifting back to their aggressive strategy in Google search and increasing competition in most metros.

Stay tuned as we update these metrics every quarter. Curious how much your market is affected by apartments.com online presence? Reach out to an account manager for more info.