SimulSearch = a focus group aimed at journey mapping online user behavior.

In the Fall of 2017 we hired a group of apartment renters, who were in the market for a new apartment, to let us record and document their online behavior while looking for an apartment. We call this process, a “SimulSearch” (maybe not the coolest name, but it spawned from the concept of a simulated search).

Anytime we mention these journey mapping research studies to clients, they lean forward and immediately ask what we found out about the ILS’. Well, that’s what we are going to talk about today. The ILS’ that we chose to focus on are:

-

Apartments.com

-

ApartmentGuide.com

-

ForRent.com

-

Zillow.com

-

ApartmentList.com

The Pepsi Challenge? Our users couldn’t really tell the difference….

After running tests on the five aforementioned ILS’ we found that it made sense to bucket four of the five ILS’ together due to very similar user behaviors; apartments.com, apartmentguide.com, forrent.com, and apartmentlist.com. With the exception of Zillow.com, user behavior on the ILS’ was not unique enough to break out.

Ok, but does the cola still taste good? The short story? Very.

Let’s look at some data, shall we?

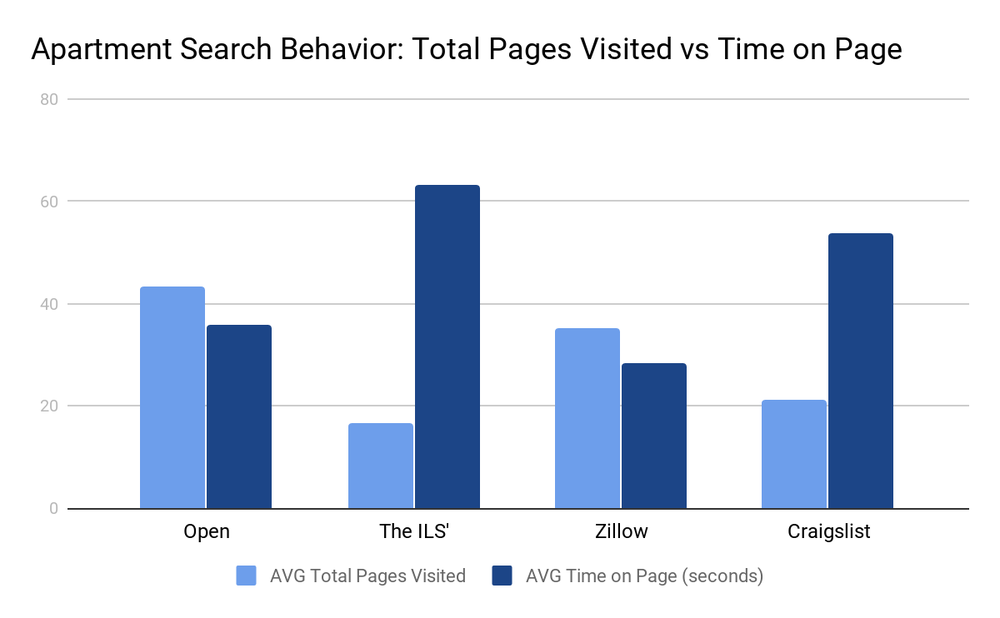

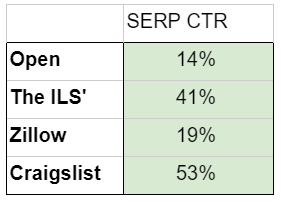

If you plan to read our entire series, get used to the graph above and the one after = I’ll be referencing them now and again. “Open” refers to an Open Session where users were allowed to search however they wanted. Most often, this meant that users were spending their time in Google.

The graph above shows how many total pages a user visited against the time on each page. You’ll see that the traditional ILS’ show that our test subjects navigated to fewer pages, but spent quite a bit of time on each page visited; averaging more than a minute per page!

Quick note, you’ll see that users on Craigslist.org treat that site almost like a traditional ILS.

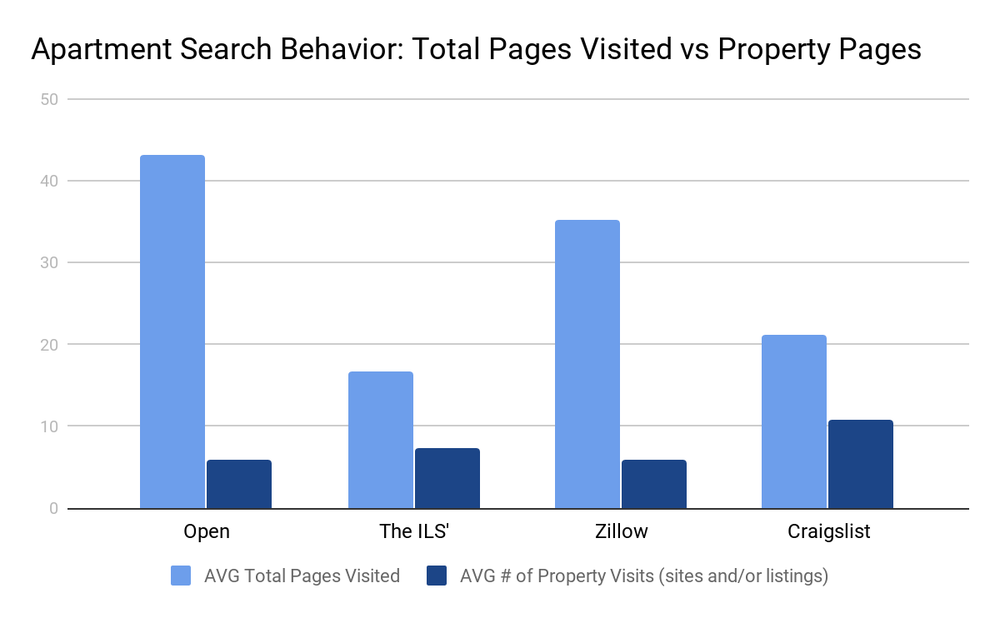

Here, we’re again leading with total pages visited, against the number of sites and/or property listings that users viewed. To keep things as even as we could, we treated a website and a property profile on an ILS the same (since most ILS’ don’t allow you to click through to a property website).

Regarding the ILS’ you’ve probably picked out that the ratio of SERP (Search Engine Results Page) navigated to against property sites/listings is much more favorable than any of the other platforms. We’ll get into more detail around this further down in the article.

Again, I’d like to point out how CL and the ILS’ show like user behavior, whereas Zillow and Google are most comparative.

Let’s wrap the data analysis by simply breaking everything down to a CTR (Click-Thru-Rate) for each of the different platforms. Do you find this data surprising? Essentially, a user on a traditional ILS does a quick search, and clicks through to a property page a staggering 41% of the time! Compare that to our Open Session (essentially Google) where a user might run 7 different searches before clicking into a link.

So what exactly did people do on the ILS’?

Ok, so…. What happened? Let me walk you through the most typical path we saw on the traditional ILS’. In this case, we’ll use the Grand-daddy of them all, Apartments.com as our subject.

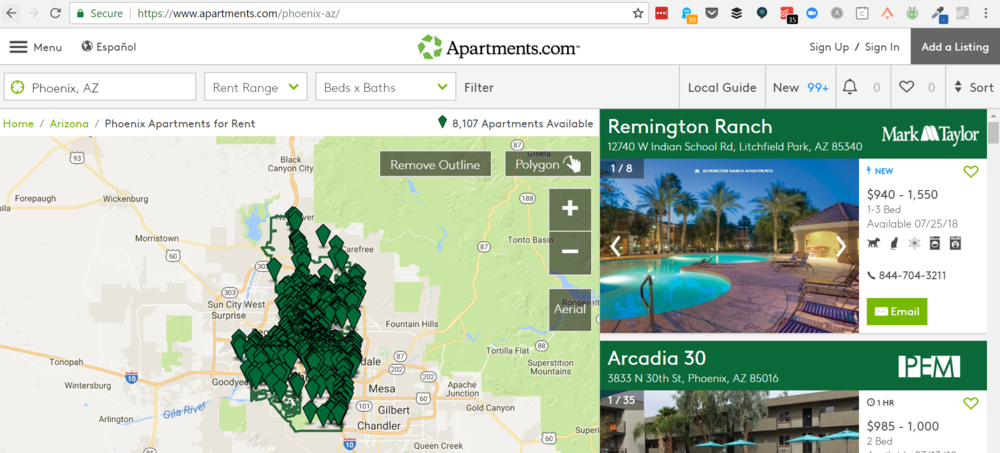

When we ran our ILS study in Gilbert, AZ, users started on Apartments.com and immediately dropped in “Phoenix, AZ”. When the SERP was returned, the users would find a huge mass of listings – too many to work with.

Btw, from here there are 17 Pages of Diamond Listings on Apartments.com…. Wowsar.

Ok…. so what’s a user to do.

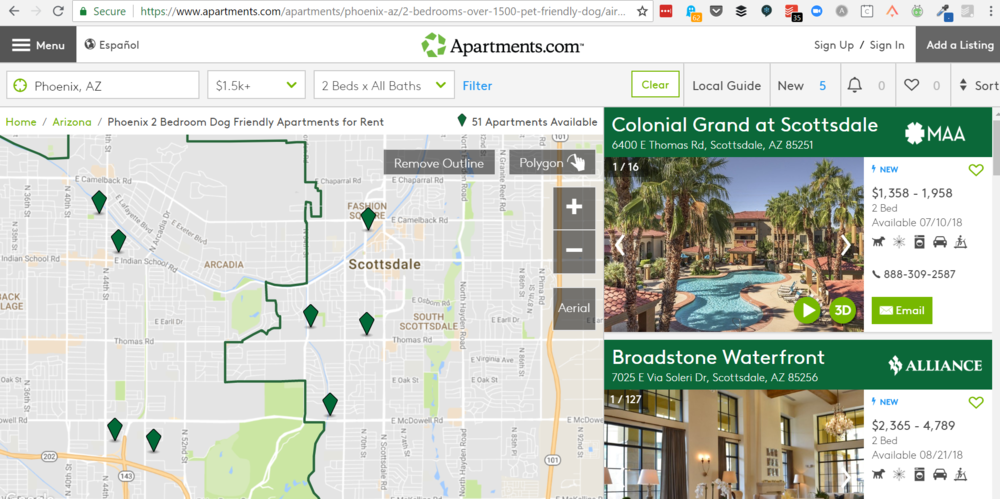

Without even clicking a listing, users would drop in a few filters.

That’s better… but still too much to work with. So users would drop-in, or zoom into a neighborhood.

Cool, so now the user jumped into a neighborhood. And check that out, instead of 17 pages of Diamond advertisers, we have eight TOTAL listings.

From here we’d see a user navigate to nearly every listing to shop/compare communities.

Ok, so how can I leverage this?

For Phoenix, AZ the answer is clear. An advertiser can bury themselves in an ocean of Diamond Listings, competing with more than 425 other advertisers.

OR, perhaps purchasing a silver listing might be the better ROI (return on investment) = a much lower cost, and in most instances, we saw people filter down their search to less than 10 property listings.

But there’s a catch.

So the ILS’ are:

-

Easy to advertise on

-

Generate a lot of highly engaged traffic

-

And now we’ve got you thinking that perhaps it doesn’t have to be a Diamond Apartments.com listing or bust

-

We believe you should almost always have a presence

-

So what’s the catch?

The catch is that nearly all of our test subjects, after finding a property they were interested in, would leave the ILS portal and run a search on Google to find the property website. In their exit interviews, our subjects said that they weren’t able to get a good enough feel of the property from the ILS and wanted to visit the property website to read more about the asset, the amenities, and flip through additional images.

To sum it up.

From our research, the ILS’ have a place in the marketing mix. They can provide good value, but to maximize their impact you’ll want to make sure that the property website ranks well on Google, or is running a branded Paid Search campaign (running a branded SEM is effective and inexpensive, but there are some caveats that we’ll get into in another article), so that a user can easily find the property website after their interest was piqued on the ILS. The apartment website itself should have fresh photos, updated specials, and great copy = don’t drop the ball at the goal line.

In our next SimulSearch article, we’ll get into how our subjects interacted with and used Google while searching for their next apartment.

Stay tuned, and give us a holler if you want to chat more about our research!